Meltem Demirors on X: "6/ so assets decline in value and duration goes long short term liabilities increase in value and duration becomes short assets and liabilities are now mismatched since the

Short-term and long-term liabilities of hotels in AP Vojvodina (in 000 RSD) | Download Scientific Diagram

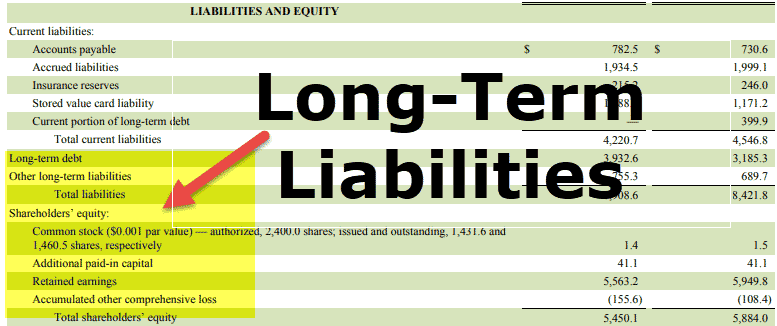

:max_bytes(150000):strip_icc()/Long-TermDebt-FINAL-78bb33e797684e6d85085b02a68ed204.png)

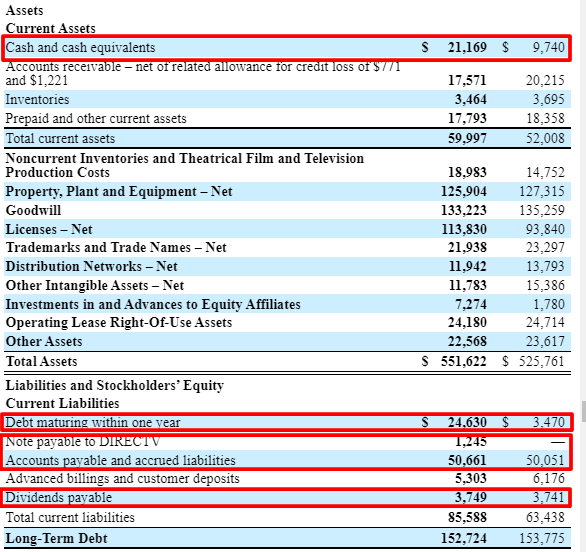

:max_bytes(150000):strip_icc()/Clipboard01-1095385694ff4af0bc51b6410f68b5fe.jpg)